The insurance industry is rapidly evolving, and modern lead scoring methodologies are at the heart of driving actionable insights. Today, insurers leverage AI and predictive analytics to improve underwriting, risk assessments, and claims processing. This article dives into the fundamentals of lead scoring in the insurance sector, examines how predictive tools are changing the game, and provides actionable strategies for maximizing conversion rates.

With a well-structured approach to lead scoring, insurers can streamline their sales pipelines, segment prospects effectively, and allocate resources to prospects that show real engagement potential. Whether you’re part of a startup or a global firm, understanding these criteria is key to staying ahead.

Contents

- 1 Understanding Lead Scoring in the Insurance Industry

- 2 Integrating AI-Powered Predictive Lead Scoring

- 3 Key Metrics and Factors in Insurance Lead Scoring

- 4 Building a Tailored Lead Scoring System for Insurance

- 5 Common Challenges and How to Overcome Them

- 6 Practical Strategies to Maximize Lead Conversion

- 7 The Future of Lead Scoring in the Insurance Sector

- 8 Best Practices and Real-World Examples

- 9 Final Thoughts on Optimizing Lead Scoring in Insurance

Understanding Lead Scoring in the Insurance Industry

Lead scoring isn’t merely a buzzword. It’s a cornerstone for modern insurance lead management. By assigning a score to each prospect based on their behavior and other qualifying criteria, insurance companies can prioritize outreach and minimize wasted resources.

This method has transformed traditional practices. Insurers now leverage technology to analyze vast amounts of data, ensuring that the right leads move forward in the sales cycle.

The Evolution of Lead Scoring in Insurance

Historically, lead scoring was a manual process, heavily reliant on intuition and historical data. Today, advances in artificial intelligence mean that the criteria for scoring leads are more dynamic and data-driven. Experts have noted that AI is revolutionizing the insurance industry by enhancing risk assessments, streamlining claims processing, and detecting fraud. This progress is a game-changer for marketing and sales teams alike.

Modern algorithms integrate numerous data points-behavioral signals, demographics, historical engagements, and more. This evolution has paved the way for more precise targeting and improved customer interactions.

Core Components of an Effective Lead Scoring System

At the heart of any effective lead scoring strategy are robust criteria developed from a blend of quantitative data and qualitative insights. Insurers use a combination of multiple factors to predict a lead’s likelihood to convert.

These components often include:

- Behavioral data such as website visits, email clicks, and engagement with digital content.

- Demographic information, including age, location, and occupation.

- Historical interactions, like previous claims or inquiries.

- Credit history or risk profile, which can impact underwriting decisions.

- Predictive analytics from AI tools that refine traditional models.

This multi-faceted approach allows insurers to create a comprehensive view of each lead, ensuring that outreach efforts are targeted and efficient.

Integrating AI-Powered Predictive Lead Scoring

The integration of AI into lead scoring has made a significant impact on how insurance companies qualify and prioritize prospects. With predictive scoring systems, insurers can forecast behaviors and adjust strategies in near real-time.

Companies worldwide are discovering that predictive lead scoring boosts conversion rates substantially. A recent survey revealed that 70% of high-growth companies already use these systems successfully.

How AI Enhances Predictive Lead Scoring

AI relies on comprehensive data sets and sophisticated algorithms to assess prospect intent. Automatic adjustments based on real-time signals ensure that the lead score is current and accurate.

By leveraging machine learning techniques, AI systems identify patterns that might otherwise go unnoticed. For instance, systems using decision tree models have been shown to outperform other machine learning techniques in forecasting corporate credit ratings (study on forecasting Corporate Credit Ratings). This approach is particularly valuable in the insurance sector, where risk evaluation is critical.

Real-Time Data and Increased Engagement

With systems such as HubSpot’s AI-powered predictive lead scoring upgrade, insurers now have access to real-time activity signals and intent data. This upgrade truly bridges the gap between traditional CRM functionalities and advanced AI capabilities. The result is a more fluid, responsive lead management process that ensures no potential opportunity is missed.

This approach allows sales teams to engage with prospects while their interest is at its peak. Quick, targeted follow-ups can be the difference between conversion and a lost opportunity.

Key Metrics and Factors in Insurance Lead Scoring

Effective lead scoring in insurance is built upon a robust framework of metrics that ensure both accuracy and efficiency. These metrics are not universally fixed. Instead, they can adapt based on company goals and market conditions.

To design a lead scoring framework suited to your company’s needs, it’s crucial to understand which metrics truly influence conversion rates and how to fine-tune them over time.

Behavioral Indicators

Behavioral data is one of the primary drivers in modern lead scoring approaches. Engaging with digital channels-whether that’s clicking an email, viewing a website page, or watching a video-sends clear signals about a prospect’s potential interest.

Insurers track these interactions through automated platforms that compile the data into actionable insights. Frequent website visits or downloads of policy information usually signal that a lead is moving closer to the decision phase.

Behavioral signals often include:

- Engagement with email campaigns

- Visits to key product pages

- Time spent on the website

- Download of whitepapers or informational brochures

Demographic and Firmographic Data

While behavioral data offers insight into what a prospect is doing, demographic information can tell you who they are. Insurers must balance these two aspects to build a holistic view of each lead.

For personal lines insurance, demographic factors like age, income, and geographic location are critical. Processing granular details allows companies to tailor their offerings, whether it’s auto insurance, homeowners insurance, or life insurance.

For commercial policies, firmographic data, which includes company size, annual revenue, and industry type, becomes crucial. This information is particularly important when underwriting policies for businesses.

Creditworthiness and Financial Indicators

In the insurance world, especially when underwriting risk, financial stability remains a key consideration. Credit history and financial behavior can serve as potent indicators of future behavior. For instance, insurers often look at an applicant’s credit score to determine premium rates and coverage limits.

Incorporating credit data into lead scoring models ensures that leads with a stable financial background get prioritized. This is in line with the growing reliance on predictive models that drill down into unique patterns and historical data.

Intent Data and Predictive Analytics

Intent data is a new frontier in lead qualification. It captures signals indicating where a lead is in the buying journey. For the insurance industry, this could mean repeated searches for policy benefits, comparisons of policy quotes, or online inquiries that demonstrate an imminent need for coverage.

Predictive analytics tools take this data and transform it into actionable insights. Using intent data, insurers can forecast the best time to engage a prospect, thereby significantly increasing the odds of conversion.

Building a Tailored Lead Scoring System for Insurance

Not every insurance provider is the same, and neither are the leads they pursue. Customizing a lead scoring system ensures that criteria align with strategic goals, market demands, and product specifics.

Building this system requires understanding both the quantitative and qualitative aspects of your leads from the beginning of the process.

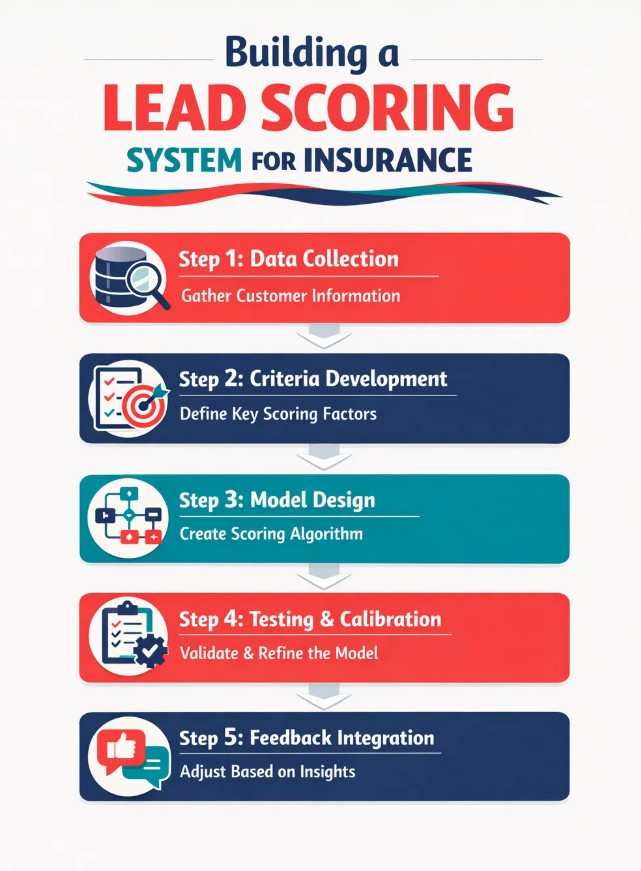

Step-by-Step Approach to Implementation

Successful implementation begins with a clear definition of what constitutes a qualified lead. This definition should arise from input across marketing, sales, and underwriting teams. A collaborative approach ensures that the lead scoring model is both comprehensive and realistic.

Key steps include:

- Data Collection: Begin by gathering historical data from multiple channels, including digital interactions, customer calls, and claims data.

- Criteria Development: Identify the key metrics that correlate closely with successful conversions. These metrics can range from behavioral interactions to demographic details.

- Model Design: Work with data scientists or third-party vendors to create predictive models that assign scores based on your criteria.

- Testing and Calibration: Implement A/B testing to refine your model and adjust thresholds for scoring.

- Feedback Integration: Establish a feedback loop with your sales and customer service teams. Data from front-line interactions can improve the system over time.

This phased approach ensures that your lead scoring system is effective from day one while allowing room for adjustments as market conditions change.

Sample Lead Scoring Framework for an Insurance Firm

| Action | Score |

| Submits quote request form | +25 |

| Opens a pricing email | +10 |

| Visits a service page 2+ times | +15 |

| Attends a webinar | +20 |

| Downloads a guide | +10 |

| Job title is business owner | +15 |

| From a target industry | +10 |

| Unsubscribes from email | -20 |

| Bounces from email | -10 |

| No engagement in 60 days | -15 |

By assigning point values and setting thresholds (e.g., 60 points = sales-ready), your team can take the guesswork out of follow-ups.

Integration with Your CRM

Seamless integration between your lead scoring model and your CRM is essential. A robust CRM acts as the backbone for your sales and marketing efforts, ensuring that every lead is tracked and analyzed accurately.

The CRM should facilitate:

- Automated lead routing based on pre-set criteria

- Real-time updates on engagement metrics

- Detailed analytics that help refine scoring models

- Easy integration with external data sources and predictive tools

Modern CRMs offer dashboards that provide a complete overview of pipeline metrics, helping teams prioritize follow-ups and measure the effectiveness of outreach efforts.

Leveraging AI and Machine Learning

Integrating AI and machine learning into the lead scoring process creates a dynamic environment where models adapt based on new data. By continuously recalibrating scoring factors, AI-driven systems optimize the performance of your outreach.

Insurance companies have taken note of these benefits. According to industry reports, systems that employ AI-driven lead qualification have achieved conversion rate improvements of between 15% and 37%.

Such improvements not only accelerate policy sales but also enhance customer satisfaction by ensuring that inquiries are addressed promptly and efficiently.

Common Challenges and How to Overcome Them

No lead scoring model is without its obstacles. In the insurance industry, unique challenges often emerge from the complexity of risk assessment, data quality issues, and the dynamic nature of consumer behavior.

Understanding these common challenges is the first step in overcoming them and ensuring your lead scoring process runs smoothly.

Data Quality and Consistency

The effectiveness of any lead scoring system is directly tied to the quality of the underlying data. Inconsistent, incomplete, or outdated data can skew predictive models and lead to missed opportunities. Insurance companies must prioritize data hygiene to ensure accuracy.

Regular data audits, clear data governance policies, and robust data integration strategies help maintain the integrity of your CRM and other data sources.

Some effective strategies include:

- Standardizing data entry across all customer touchpoints

- Regularly cleansing and updating databases

- Incorporating real-time data collection tools

Adapting to Market Dynamics

The insurance landscape is not static. Changes in regulations, emerging risks, and evolving customer expectations require that your lead scoring criteria be flexible enough to adjust.

Dynamic systems that incorporate AI provide the agility needed to recalibrate as new data emerges. By monitoring industry trends and integrating real-time behavioral data, insurers ensure that their scoring models remain relevant.

Keeping an eye on market dynamics also involves continuous training for staff and systematic feedback from every stage of the customer journey.

Overcoming Adoption Barriers

While technology has advanced, human factors can slow the adoption of new systems. Transitioning to an AI-powered lead scoring model may meet resistance from teams accustomed to manual processes.

To overcome these barriers:

- Invest in comprehensive training programs

- Demonstrate the tangible benefits through pilot programs

- Encourage cross-departmental collaboration to foster buy-in

By addressing concerns and highlighting early successes, insurers can facilitate a smoother transition to data-driven practices.

Practical Strategies to Maximize Lead Conversion

An effective lead scoring system is only as good as its ability to drive action. Once leads are scored and prioritized, strategic outreach and follow-up can transform high scores into tangible policy sales.

The process involves tailored communications, timely follow-ups, and leveraging automation where possible.

Aligning Sales and Marketing

A strong collaboration between sales and marketing teams ensures that the lead scoring strategies align with overall revenue goals. By keeping communication lines open, teams can adapt quickly based on real-time feedback from prospects.

Both teams should be committed to refining the criteria continuously, making data-driven decisions that enhance conversion rates.

Some best practices include regular strategy meetings, shared dashboards, and integrated workflows that ensure timely follow-up.

Personalizing Outreach with AI

Personalized outreach remains the cornerstone of high conversion rates. AI tools not only prioritize leads but also enable campaigns tailored to individual behaviors and preferences. In the insurance industry, where trust and clarity are paramount, personalized communication can set you apart.

Examples of personalized strategies include:

- Customized emails based on previous interactions and interests

- Targeted social media campaigns that address specific risk profiles or needs

- Automated reminders for policy renewals or updates

These tactics enhance engagement by making each prospect feel uniquely valued and understood.

Efficient Follow-Up and Pipeline Management

Efficient pipeline management is a significant factor in conversion. High-scoring leads should receive prompt and customized follow-ups to maintain interest and expedite the sales cycle.

Utilizing CRM integrations and automated workflows can ensure that no lead slips through the cracks. Tools that provide timely notifications about high-engagement actions allow sales teams to reach out when interest is at its peak.

This responsiveness often translates to shorter sales cycles and higher overall conversions.

The Future of Lead Scoring in the Insurance Sector

The insurance industry’s trajectory is clear: data-driven, AI-enhanced operations are here to stay. As predictive models become more refined, insurers will continue to benefit from precise, actionable insights.

Expanding technology integrations and evolving consumer behaviors mean that your lead scoring system must evolve, too. Forward-thinking insurers are already investing in next-generation systems that integrate multiple data streams for a holistic view of customer behavior.

Emerging Trends and Innovations

One emerging trend is the integration of decision tree-based models in forecasting corporate credit ratings, which have shown significant promise in refining risk assessments (research on forecasting models). Insurers are also exploring the use of neural networks and support vector machines for even deeper insights.

Predictive analytics is continuously evolving, and the implementation of advanced forecasting models could soon become standard practice. As more advanced algorithms emerge, you’ll see efficiencies not only in lead scoring but in the entire sales and underwriting process.

Opportunities for Cross-Sector Learning

The insurance industry is not alone in leveraging advanced lead scoring systems. Sectors like technology, media, and telecommunications have often been at the forefront of adopting AI-driven processes (Boston Consulting Group study). By studying these industries, insurers can learn and apply best practices in risk analysis and lead prioritization.

Collaboration across sectors helps drive innovation and encourages the adoption of disruptive technologies that improve overall performance.

Preparing for a Data-Driven Future

For insurers, the journey towards a fully data-driven lead scoring system is an ongoing process. Continuous investment in training, technology, and data governance will be essential. As more data becomes available and models get refined, AI systems will become even more adept at foreseeing market trends and customer needs.

This evolution promises not only enhanced conversion rates but also a more customer-centric, proactive approach to risk management and policy underwriting.

Best Practices and Real-World Examples

Practical examples and best practices can offer invaluable guidance as you refine your lead scoring criteria. Successful implementations show that tailored strategies, advanced analytics, and tight integration between tech and team are the keys to success.

Below are some actionable tips and real-world examples to consider as you build or upgrade your lead scoring system.

Case Study: Sure Life Insurance Improves Lead Quality with Strategic Lead Scoring

Breaking into new health insurance accounts is challenging, especially when prospects have entrenched provider relationships. For Sure Life Insurance, traditional cold calling wasn’t producing the quality conversations needed to grow.

By partnering with Abstrakt, Sure Life shifted from volume-based outreach to a lead–scoring–driven qualification model. Prospects were evaluated using a combination of firmographic fit (company size, industry, and decision-maker role), behavioral engagement (email interaction, content interest, and response history), and buying intent signals such as timing, expressed needs, and openness to reviewing coverage options.

This scoring framework allowed Abstrakt to prioritize outreach and schedule appointments only with prospects that met Sure Life’s ideal customer profile, ensuring sales conversations started with higher intent and stronger alignment.

“Abstrakt wasn’t just setting appointments—we were hitting prospects from every angle,” said Ryan of Sure Life Insurance. “That made a huge difference in the quality of the conversations.”

With clearly defined scoring criteria and consistent omnichannel outreach, Sure Life saw stronger engagement, more qualified B2B appointments, and a more predictable pipeline built for long-term growth.

Implementing Continuous Improvement Processes

Once your lead scoring system is in place, the work is far from over. Continuous improvement is essential to ensure the model keeps pace with changing market dynamics and consumer behaviors.

Measure the system’s performance regularly against key metrics such as:

- Conversion rates post-outreach

- Lead response times

- Customer satisfaction levels

- Accuracy of risk assessments

Incorporate feedback from both the sales team and customer experiences to fine-tune the models. Adjust thresholds, refine criteria, and update processes in real time where possible.

Aligning Technology with Company Culture

Technology is only as effective as its integration with your company’s culture and workflow. Ensuring that your teams understand the benefits of the new scoring system and are actively involved in its evolution is crucial. Training sessions, workshops, and regular feedback loops help bridge the gap between technical systems and frontline execution.

Promote transparency by sharing performance dashboards and highlighting success stories that arise from the new lead scoring methodologies. This builds team trust in the systems and fosters a proactive environment focused on continuous improvement.

Final Thoughts on Optimizing Lead Scoring in Insurance

A comprehensive lead scoring system is an indispensable tool for driving innovation and conversion in today’s insurance landscape. The integration of AI-driven technologies coupled with personalized, data-driven outreach has redefined the way insurers handle prospects and manage risk.

As insurers continue to adopt and refine these systems, incorporating robust metrics, advanced predictive tools, and a proactive feedback loop remains critical. Establishing a system that evolves in line with market demands is not just smart-it’s essential for staying competitive.

Key Takeaways

Before wrapping up, here are the key points to remember:

- Lead scoring, when done right, significantly enhances conversion rates and reduces wasted efforts.

- AI and predictive analytics add a powerful dimension by enabling real-time adjustments and more precise outreach.

- Effective scoring systems integrate behavioral, demographic, and financial indicators into a unified model.

- Continuous testing, feedback integration, and regular updates are essential for sustaining long-term success.

Implementing these strategies will not only create a more efficient lead management process but will also help build long-lasting customer relationships.

Looking Ahead

As the insurance industry steps deeper into the realm of digital transformation, the future looks promising. Future improvements will likely focus on finer predictive analytics, even more seamless CRM integrations, and deeper personalization of customer interactions.

Ultimately, the goal is simple: to create a lead scoring ecosystem that is both agile and robust, capable of adapting to changing market conditions while consistently delivering quality, conversion-ready leads.

For insurance companies that want to stay ahead of the curve, investing in a well-planned, data-driven lead scoring strategy is the way forward. With the right tools and a clear understanding of key metrics, you can ensure that every lead is given the attention it deserves-and every opportunity for conversion is maximized.

Ready to transform your insurance lead scoring with the power of AI and predictive analytics?

Abstrakt is here to elevate your insurance lead generation strategy. Our expertise in digital marketing and appointment setting has helped businesses like yours generate consistent, high-quality leads, setting 100,000+ appointments a year. Don’t miss out on the opportunity to optimize your sales pipeline.

Send us a message today, and let’s discuss how we can support your growth and maximize every lead conversion opportunity.

Madison Hendrix

Madison has worked in SEO and content writing at Abstrakt for over 5 years and has become a certified lead generation expert through her hours upon hours of research to identify the best possible strategies for companies to grow within our niche industry target audiences. An early adopter of AIO (A.I. Optimization) with many organic search accolades - she brings a unique level of expertise to Abstrakt providing helpful info to all of our core audiences.